Why ADF Group still has an 1-2x upside over the next year despite growing 300% over the last year

How a company with a 300% price increase over the last year can be cheaper than ever

Disclaimer: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I am guessing most people who venture in the small/microcap space are familiar with ADF Group by now, and their story related to automation investments, revenue and margin growth over the last 12 months. I also briefly wrote about it in my last post, Why I believe my portfolio will outperform over the next 5 years.

This post is not meant to be an extreme bull thesis for ADF Group that convinces you to put all of your net worth into the stock. It’s one of my high conviction bets and I have about 6% of my portfolio in it, but to be honest, it’s not my highest conviction bet.

However, given what I read from comment sections on Twitter, I feel the need to explain a bit more around the story and why it is so compelling, supported by some quick and dirty back-of-the-envelope calculations.

The thesis

ADF Group has experienced an outstanding stock price increase over the last 12 months, surging ~300% over the period:

(ADF Group stock price from 10th of July ‘23 until 9th of July ‘24)

As you also might too see from the chart above, the stock price has decreased -11,7% over the last month and -27,7% from its top at C20.5$ on the 11th of June. It was cheap at C20$, and it is even cheaper now. This is partly the reason why myself and others are screaming BUY on Twitter, and see this as one of the best trades in the market today. Still, a lot of people don’t seem to fully see what us bulls are seeing. Comment sections are dominated with comments like: “People acting like this drop is a big deal, it’s up over 100% YTD”, “Bro, it’s up 60% over the last 3 months, stop complaining”.

Let’s examine why this stock still is very cheap, and why I believe it has a credible path to growing another 1-2x over the next 12 months.

Today’s valuation is low when looking at EBITDA growth, historical valuation, as well as comparing with industrial peers

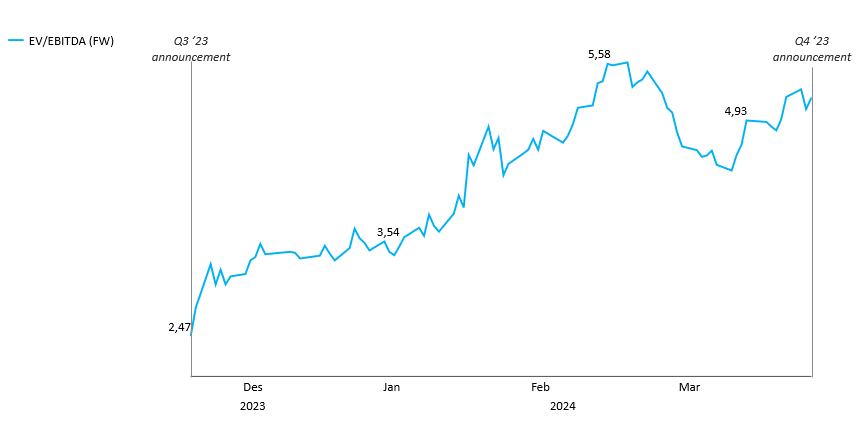

Graph 1: Historical valuation

(Note: Forward EBITDA calculating by annualizing EBITDA from most recent Q announcement)

Last year, ADF Group traded around 3x EV/EBITDA, which might have been fair. This was a sleepy, cyclical industrial company with not too many exciting things happening in terms of revenue and profit growth. However, over the last year, revenues and EBITDA has exploded, and the market still hasn’t fully taken notice. The same pattern has also happened before. Last year, the company was only trading at ~3x EV/EBITDA while EBITDA was growing 27% and 16% over the two previous quarters (on 7th of December ‘23).

However, after the 7th of Dec 23 (Q3 23 announcement), the market started waking up. Two quarters in a row with explosive EBITDA growth finally got people’s attention. Slowly, but surely from the 7th of Dec 23 to the 11th of April 24, the valuation re-rated from 2,5x EV/EBITDA to 5,5x EV/EBITDA and we saw a big run-up in the stock price.

Graph 2: Daily EV/EBITDA (FW) development

On the 11th of April this year, ADF Group again reported quarterly results, this time for Q4 23. And what we got was yet another 16% quarterly growth in EBITDA (see Graph 1). It didn’t happen immediately this time either, but the market eventually couldn’t hold its excitement back. EV/EBITDA slowly re-rated from 5,5 to 7,2 from the 11th of April until the 11th of June, and the stock price yet again jumped. The market started to appreciate the quality of ADF Group, and started pricing it similarly to its industrial peers who trade at 10-15x EV/EBITDA.

Then, on the 11th of June this year, ADF Group reported Q1 24 results. The market didn’t know what to expect. Could the growth over the last quarters be sustained? Q1 is also usually a weak quarter. The results were a whopping 32% quarterly increase in EBITDA, during a quarter which is usually seasonally weak. No only that, the company also announced a buyback of ~9% of its outstanding shares. Just wow. This is company is both returning capital back to its shareholder and not showing any signs of slowing down. Wonder what the market thinks of these news? Well, as of the 9th of July, the multiple has downrated -28% to 5,2 EV/EBITDA. You tell me whether this is reasonable for a company growing EBITDA 100% YoY and returning capital back to its shareholders.

So why did this downrating happen? Has the market lost faith in ADF Group’s growth prospects? Are we missing something here? I don’t think we are. The stock downrated probably at least partly due to selling pressure from one of its biggest shareholders, Marshall-Barwick Holdings, who decided to aggressively sell down their position. Probably to take profit, maybe also in time for the changes to Canada’s capital gains tax, which was effective from the 25th of June. I can’t blame them. They probably had an amazing gain and they are probably not value investors.

The growth over the last 12 months is sustainable and will continue for the foreseeable future

The company’s order backlog was $427.5 million as of April 30, 2024, excluding new contracts announced on May 28, 2024 which would bring it up to ~$517 million as of 11th of June, which is promising for the rest of the year. Not only was the backlog initially higher than ‘23 revenues, but we did as recently as less than two months ago get an announcement which increased the backlog with yet another ~20%.

Management has also been vocal about their positive market outlook. About a year ago the CEO commented that they “definitely see growth for the coming 3, 4, 5 years.” In a recent interview with Atrium Research (published on the 10th of July), the CFO reiterated the positive market outlook previously stated by the CEO.

Another data point underscoring the future growth Management sees in this business is how aggressively they are hiring:

(From ADF Group’s LinkedIn page, posted 3 weeks ago as of the date of this publication)

One of the big drivers underpinning this growth is of course the US Bipartisan Infrastructure Law. Two years ago, President Biden signed the Bipartisan Infrastructure Law (“BIL”) into law. The BIL directs $1.2 trillion of federal funds towards transportation, energy, and climate infrastructure projects. In his recent interview with Atrium Research, the CFO also stated that the infrastructure packages in the US have barely started to being utilized.

ADF Group is set for scale and able to handle the growth

Management has said that there is still room to grow with their existing facilities without heavy CAPEX investments. In his recent interview, the CFO didn’t give a concrete number as to what the revenue capacity they currently have, but I have seen people on Twitter say that ADF Group would be able to handle CAD 1 billion in revenues with their current facilities. I’m sure this is taken from somewhere, but I don’t have the source for that statement, so take it for what it is.

“But it’s cyclical”

It’s no secret that this is a cyclical business. Despite this, it’s still too cheap with a ~5x EV/EBITDA on a business growing at this pace and with all the signs pointing towards further growth at the beginning of what seems to be a cyclical upturn for the industry. I have to be honest, I am not planning on owning this business forever, but I do intend to ride this cycle for as long as I can.

Given that the cyclicality of this industry is a common bear argument for the stock, let’s examine it a bit further:

You read previously in this post that the CEO and the CFO sees growth over the next 5 years. If we look at the company’s operating cash flow as reported for its 2023 fiscal year, then ADF is currently trading at a 16% OCF yield (using operating free cash flow as the company as ~0 net debt and does not need heavy CAPEX to handle current growth trajectory).

Let’s now assume that the stock price doesn’t move, and that the company can grow its operating free cash flow modestly at 12% a year over the next five years before all projects stop, the cycle is over and all revenues and cash flow go to zero and disappear (which is of course a wild exaggeration). Now, especially working capital is lumpy for this company, which gives YoY fluctuations in operating free cash flow, so hard to extrapolate cash flows accurately. But let’s say that the 2023 cash flow level and a 12% growth is directionally right when calculating the average over the next five years.

Should this be the case, then the company would be able to pay back its entire market cap within the next five years. And, in fact, they have already started paying back to shareholders. Not only do they already issue a dividend, they also reported a 9% buyback, as you read earlier in this post. And remember, we are not making any wild assumptions here. We’re saying that a business which has grown its EBITDA 100% YoY will be able to sustain its operating cash flow from last year and only grow it modestly at 12% for five years.

No one knows how long this cycle upturn will last. It could be a decade, in which case the numbers become ridiculous. Should we listen to the CEO and CFO, it sounds like we at least have 5 prosperous years in front of us.

You tell me whether you think this sounds “extremely overvalued.”

What ADF group conservatively could be worth 12 months from now

Let’s be extremely conservative and say that ADF Group should trade at 8x 2025 EBITDA, which is around the same multiple as steel fabricators trade for. I still believe ADF Group should trade higher, but let’s be conservative and leave some margin of safety.

If we also assume that the company will not get any extra margin benefit from their current automation platform (remember, the CFO said that there is still room to squeeze out some margins, despite the majority being taken out), then we are looking at a ~22% EBITDA margin going forward (EBITDA margin for last quarter).

Revenues grew 32% from FY22 to FY23. With their current revenue trajectory, the company is looking at doing something north of CAD 430m in revenues for FY24, which will be a yet another 30% revenue growth from FY23. Let’s say that growth is cut down to 20% in FY25 (don’t know why it should, but we are being conservative here). Then you are still looking at something along the lines of CAD 516m in revenue for FY25, which with a 22% EBITDA margin would translate into CAD 114m in EBITDA for FY25.

Putting an 8x multiple on CAD 114m would give us an enterprise value of CAD 912m which would give us a ~88% upside over the next 12 months from today’s stock price. If we put an 10x multiple on that EBITDA (which is still at the lower end of what industrial peers trade at, but still very reasonable for this growth and cash generation) we get CAD 1,14bn in enterprise value, which is a ~135% increase from today.

I don’t know what the EBITDA or the multiple will be one year from now, but you don’t have to stretch your assumptions to get somewhere between a 88% - 135% upside.

Main risk

The main risk here is that the company will not be able to grow its backlog. Neither we, nor Management, know what the backlog will be in 1 year. However, given that we are in what appears to be a cyclical upturn, infrastructure packages in the US that have barely started to being utilized, combined with ADF’s market position, there is no reason to believe that this backlog will not get filled over the next years.

Summing it all up

Valuation is still low when looking at what the market has been willing to price ADF Group at in the past, it’s historic growth and future growth prospects as well as when comparing to industrial peers

Current valuation leaves a margin of safety (if you believe current business will not cease to exist) as the company could be able to pay back it’s market cap in cash within the next five years using reasonable assumptions

The company is shareholder friendly and has shown willingness to give back to shareholders

All signs points towards further growth for at least the next 5 years

Conservative valuation estimates indicate a 88%-135% upside over the next year, with potential for more over the coming years

- H Capital Investing

Thanks for putting together these thoughts on ADF. That's a compelling and coherent investment case.

Re point 3) The source is the CEO in the most recent Conf call - here at 11:10

https://app.webinar.net/EPnVjR6jr71/on-demand

In cases like this, usually what happens is your underwriting on earnings is too aggressive. I've seen the "it's cheap, will return the market cap in x years" thesis blow up dozens of times before, and it's always because the cash didn't materialize.

The market is telling you this is peak earnings. Backlogs can be cancelled, work stopped/halted, budgets changed (esp after an election year). I'm not sure I'd be so fast to rest my hat on that as a justification for it being particularly cheap, and I think to really convince people of the thesis that's what you need to prove out. Why can't their backlog be cancelled? How fast is it growing? Who are their counterparties, what are they building, why won't it stop/is it funded etc.