Diversification, value and a couple of new ideas

A value investor's hunt for undervalued resources and shiny metals below the surface

Disclaimer: The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Introduction

Late May this year, I launched this blog and started writing about the ideas in my portfolio and my general investing philosophy. My post from July, Why I believe my portfolio will outperform over the next 5 years received more attention than I ever anticipated, getting almost 50 likes and boosting my follower count on X with about 100%.

Since then, through trial and error, victories and defeat, I have evolved quite a lot. The cornerstone of my philosophy is the same: I am looking for smash-you-in-the-face cheap and predictable cash generation which for some reason (and there can be many) trade at such a steep discount to projected cash flow that you hardly need a financial model to see the disconnect. Ideally, there should also be a concrete plan, or communicated willingness, of returning capital to shareholders. Mix that with patience and the ability to compound capital, and you might have found yourself a three-engine (multiple expansion + FCF growth + capital return) multibagger.

Following that the cornerstone of my philosophy is the same, most of the same names mentioned in my original post Why I believe my portfolio will outperform over the next 5 years still make up the majority of my portfolio: Cipher Pharmaceuticals (CPH.TO), Vistry (VTY.L), International Workplace Group (IWG.L), BQE Water (BQE.V), Sintana Energy (SEI.V) and Terravest Industries (TVK.TO) make up ~55%. The biggest difference from my original post is that I completely sold out of Lumine Group (LMN.V) on the 7th of August for a ~90% gain due to a valuation that was getting too full for my liking, and that I have fairly significantly reduced my Terravest Industries holding for the same reason.

So, with that in mind: What has changed and which new ideas have come up?

‘Diworsification’

Diversification is a protection against ignorance. It makes very little sense for those who know what they're doing.

Warren Buffett, Berkshire Hathaway's 1993 Annual Shareholder Letter

Instead of buying more of their best idea, they water it down with a number of mediocre ideas. That’s diworsification.

Peter Lynch, One Up on Wall Street

For many value investors, concentration isn’t just a strategy; it’s a fundamental belief that drives exceptional returns. Value investors like Warren Buffett and Charlie Munger have shown that focusing on a few high-quality investments can be a superior approach. They advocate for concentration as the true path to wealth creation, and it has become an ethos in the value investing community. I used to share the same belief, and I still believe going overweight in your best ideas is a good strategy for creating wealth.

However this year has shown me that anything can happen to individual companies, both large and small. We have seen many FinTwit favorites experiencing severe drawdowns (such as ALAR, Moberg Pharma and one of my core holdings, Vistry). I thought ADF Group was outlandishly cheap at 14, but now we are here at 10. For all of these companies, the drawdown came “out of nowhere”. This has made me think. Maybe some diversification and some protection against ignorance isn’t that bad? We can’t know it all, and very few of us are Warren Buffett.

The second point is that there are so many compelling opportunities out there if you invest across the world and across sectors in the small and microcap space. The hardest thing is often be prioritise between ideas and have a clear view on which idea is the most promising. That, combined with the fact that you can’t know it all and ‘anything can happen’, maybe spreading your bets isn’t the worst thing you can do. After all, it was also Warren Buffet who said that "I started out with a lot of ideas and no money; now I have a lot of money and no ideas." (Of course reflecting the fact that now it makes more sense for him to concentrate compared to the younger Buffett who had a broader opportunity set).

Hard value

Like I alluded to in the introduction, I sold my position in Lumine and have drastically reduced my position in Terravest. This is not because I have lost faith in these companies, and I still believe they both have exceptional Management with promising growth prospects. It’s simply because I get a lot more uncomfortable holding stretched valuations now compared to what I did before, which I think is a reflection of the other opportunities I see in the market. I just see a clearer path to a better 3-5 year IRR other places. I however think it’s highly likely that I might increase/initiate my positions in these companies sometime during the next 3-5 years, if and when there is less expectations priced into the stocks.

On the other hand, you might say that it’s too optimistic and ambitious that I would find similar quality with low expectations AND a cheap price. I have debated this with myself and concluded that I do not think it’s too optimistic. However, the cash generation/quality and price discrepancy must stem from something, which you need to get comfort around. It can be many reasons, such as the company missing earnings expectations, bearish sector sentiment, perceived uncertainty, change in investors’ preferences, macroeconomic shocks, lack of faith in management and so on. I often find my best opportunities where there is a bearish sector sentiment or perceived uncertainty as I find it more difficult to get comfort around some of the other factors.

Anyway, so I’m rambling and this post is getting too long. Let’s discuss some hard, actionable ideas…

Tenaz Energy Corp. ($TNZ.TO)

The hyper grower trading for bankruptcy multiples

Companies trading at <2x EV/FCF are usually doomed companies associated with dying sectors, declining revenues and free cash flows which are expected to fall off a cliff. And usually, the market is right. Fishing in the deep value sea can be a risky endeavor. But, not always. There is one company currently trading a this depressed, deep value multiple which is actually set to change and grow. By a lot. The fat pitch I am presenting today is Tenaz Energy Corp.

Recent events have essentially transformed Tenaz Energy into a growth company with aligned and shareholder friendly Management who just proved themselves to be excellent capital allocators, delivering a masterclass in deal-making (which I will get to later), and the market is offering this to us for a price we normally only see in the deepest of deep value territory. Many of you might be afraid of owning commodity stuff. Which is fair. I get that. Those of you who have read my previous posts know that I love predictability. Commodities are normally the opposite of predictable, given the volatile nature of commodity prices. However, as my write-up will show, Tenaz’ hedging strategy provides us with the reliable free cash flow we all seek. And we’re getting it for less than 2x EV/FCF.

Company overview

Tenaz Energy is a Canadian E&P (exploration & production) company based in Calgary which focuses on acquisition and development of international oil and gas assets. In October 2021, Tenaz Energy changed its name from Altura Energy.

Tenaz has domestic operations in Canada along with offshore gas assets in the Netherlands. The domestic operations consist of a semi-conventional oil project in the Rex member of the Upper Mannville group at Leduc-Woodbend in central Alberta. The Netherlands gas assets are located in the Dutch sector of the North Sea. Tenaz also has an ownership interest in Noordgastransport B.V. which holds one of the largest gas gathering and processing networks in the Dutch North Sea.

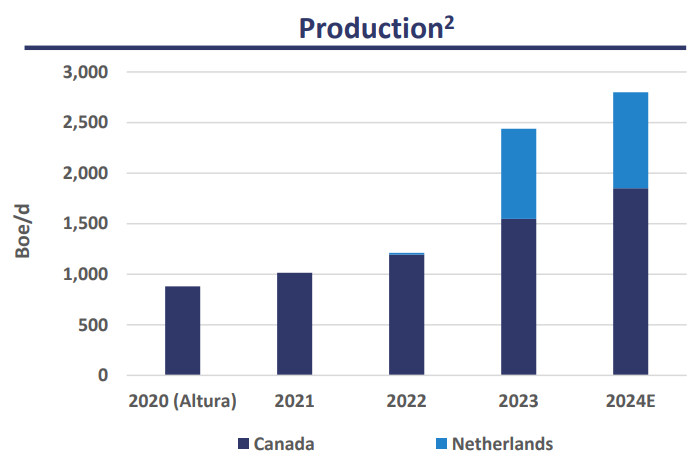

The company has steadily increased its oil & gas production, and as of May 2024, the 2024E production estimate was ~2 800 boe/d (Barrels Of Oil Equivalent Per Day), which is a respectable ~33% CAGR increase in production since 2020:

Source: Company presentation

Obviously, Tenaz derives its revenues from selling these petroleum and natural gas resources. And for those of you who might not be too familiar with oil & gas, there are two important caveats we need to bear in mind: 1) Revenues are highly dependent on the price of oil & gas, which can be highly volatile, and 2) These oil & gas assets have finite life which also require continuous drilling and development capital (D&D CAPEX) to keep production up. As such, you can not put a too high FCF multiple on Tenaz’ cash flows.

Given the oil & gas assets’ finite life, a critical component to assess the value of Tenaz’ will be to consider their estimated oil & gas reserves. Nobody can know precisely how much oil exists under the earth's surface or how much it will be possible to produce in the future. All numbers are, at best, informed estimates. Estimating oil & gas reserves is a a science of its own, and I don’t plan on going into all the details here. The most important number for us here is Tenaz’ “2P”. 2P reserves are the total of proven and probable reserves. Proved reserves are likely to be recovered, whereas probable reserves are less likely to be recovered than proved reserves.

As of mid-July this year, Tenaz Energy’s 2P was 14.6 million boe (Barrels Of Oil Equivalent). If we assume they can keep producing at ~2 800 boe/d without discovering more oil, they would be able to produce oil for another 5 214 days, or ~14,3 years. So even thou these are finite resources, we are not running out of oil & gas to sell anytime soon.

A company-transforming acquisition

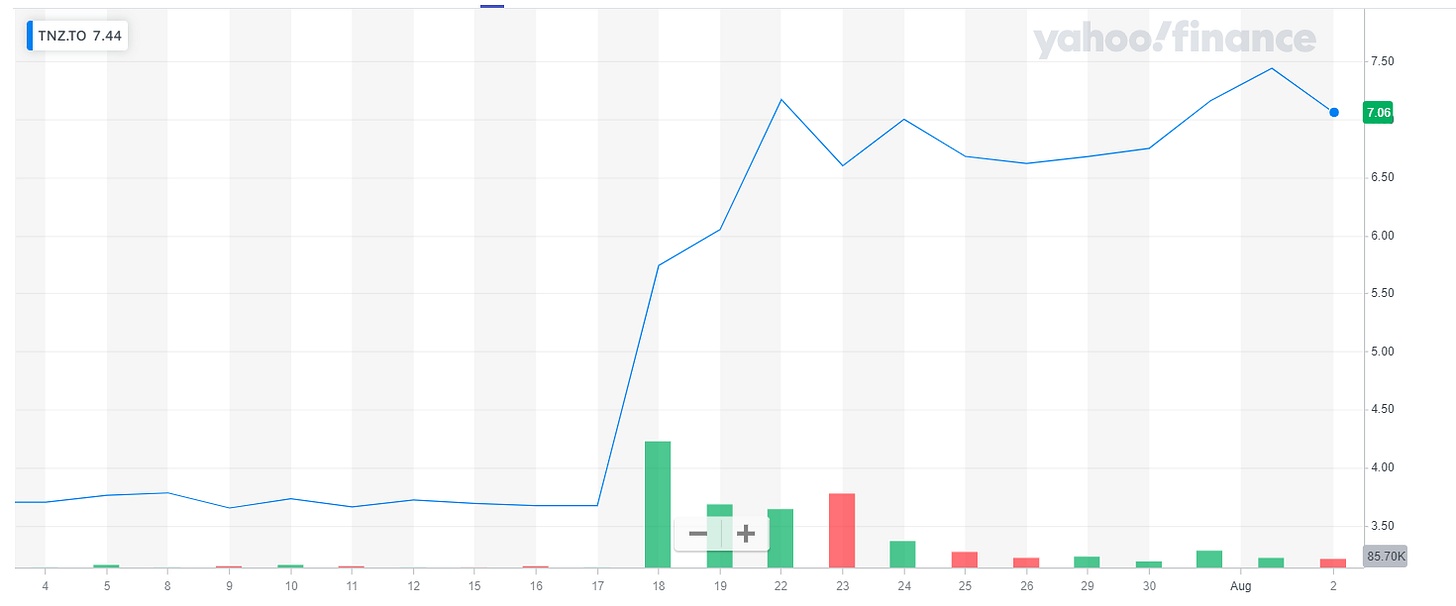

Up until now, you have gotten a brief introduction into Tenaz Energy. However, on the 18th of July, everything changed. On this date, Tenaz Enery Corp. entered into an agreement with Nederlandse Aardolie Maatschappij B.V., a 50/50 joint venture between Shell PLC and ExxonMobil Corporation, to acquire all of the issued and outstanding shares of NAM Offshore B.V. for base consideration of €165 million. The market loved it and the stock price surged close to 100% the following four days:

And the market’s positive reaction was for a good reason. I cannot stress enough how transformational this acquisition is for Tenaz. This acquisition:

Increases production from ~2,800 boe/d to 13,800 boe/d (up ~390%)

Increase 2P reserves from 14.6 million boe to 68.2 million boe (up ~370%)

After this acquisition, proforma run rate free cash flow is ~$150 million annually. Given there are about 27 million shares outstanding, this translates into $5/share of free cash flow.

And how many shares were issued as part of this deal you may ask? Zero. No equity was diluted as part of this deal. And that is part of the beauty of what Management has pulled off here. I am going to quote Malcolm Shaw at Hydra Capital Partners on the terms of the deal:

The NOBV acquisition has an effective date of January 1, 2024, but the closing date is in mid-2025. That means that the free cash flow that NOBV (the entity that is TNZ buying) is generating accumulates to TNZ’s account and will be transferred to the NOBV sellers (NAM, Exxon and Shell) on closing as payment for the assets, covering the majority of the price (~$200 million) of the deal. Significant hedges have been entered into for 46% of 2024 thru 2026 production at an average gas price of about $17/mcf. Mr. Marino and his team have not been idle while they’ve been quiet. This is a wonderfully structured deal and that’s why the stock responded the way that it did on Thursday, and why I think that’s likely to continue.

… This is a masterclass in deal-making

Also, most earn-outs are linked to FCF, not production or revenue. This means that part of the CAPEX pays for itself.

Tenaz Energy is a hyper growth company now. One could only ask oneself what will come next if we look 3-5 years out. Management has proven its abilities and are delivering on its international M&A Strategy. Additionally, the NOBV Acquisition has high margin production with hedging to generate reliable FCF. Not only have Management proven their abilities, they are also aligned: As of May 2024, insiders held 11% and 21% of basic and fully diluted shares respectively.

So what is Tenaz worth? I do not know, but atleast a heck of a lot more. All we need, in my opinion, is for the bearish oil & gas sentiment to turn and for the cash to start flowing through Tenaz’ income statement with additional upside in future M&A and improved TTF prices. Also, it’s not the first time we see the market being slow to react to transformational M&A news in the oil & gas sector.

If we were to look at some hard numbers: After-tax 1P (proven) NPV10 is ~$22,5 per share, compared to today’s share price of $9,22. Crew Energy was recently acquired for something close to $43,000 per flowing bbl per day. If Tenaz was to be acquired for the same, it would imply more than a 2x premium to current trading, and you could argue it deserves more. All of this is also happening while TTF prices have increased ~8% over the past month, partly because European inventories have stopped growing. Tenaz is just too cheap, no matter which metric you want to use. I’m aiming for a 300% upside with limited downside over the next 3-5 years.

I took a sizeable stake in Tenaz Energy Corp on the 31st of July for a share price ranging between $ 7-8 and have sinced increased my position.

Vizsla Silver ($VZLA $VZLA.TO)

Hunting for shiny treasures under ground

One does not have to go far to find bullish sentiments for the silver price:

Many investors view silver as a more affordable alternative to gold, especially when they anticipate rising precious metal prices. As gold prices increase, silver often follows, driven by both sentiment and speculative buying. The silver price often lags the gold price, and we have yet to see the same increase in the silver price as we’ve seen with gold, with the gold to silver ratio sitting at just above 80, which is below the average for the last 3 years, and with a common ratio peak around 90.

Besides this, there are impactful price increase drivers connected to rising industrial demand, economic uncertainty, supply constraints, and a weakened U.S. dollar which all point toward a potential increase in silver prices going forward.

So investing in silver can be both a good hedge against the general economy and an interesting growth opportunity. However, the challenge is often to find great silver stocks. And miners (and especially junior miners!) are often viewed as one of the most risky areas of investing. Many of you will stop reading once you read the word “junior miner”, but not all miners are created equal and the opportunity that is presented to us with Vizsla Silver is truly a great way to both play the silver theme, while also investing in a great company with exponential upside potential. Despite this, I would however be cautious with sizing it too large due to the inherent mining risks that we cannot get around.

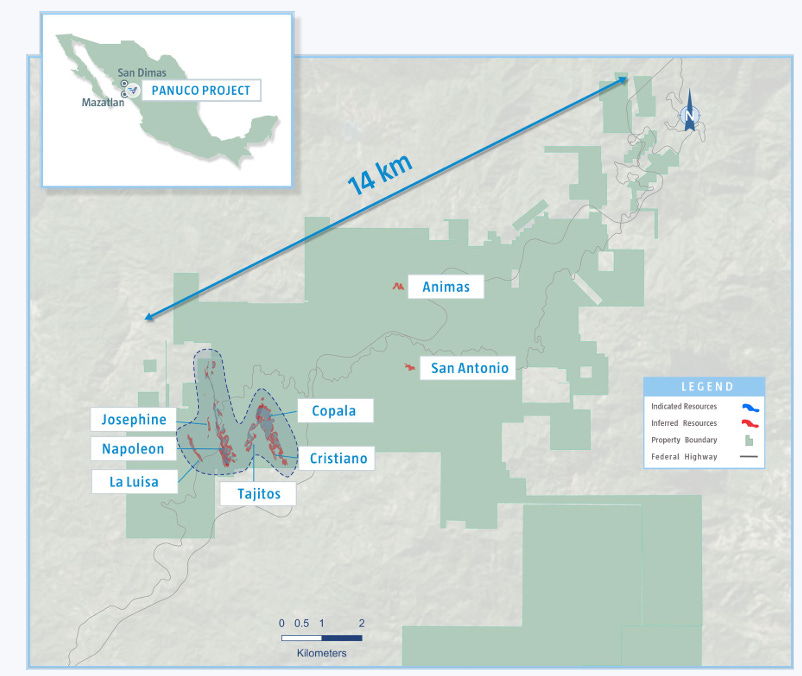

Vizsla Silver is a Canadian junior mining company focused on exploring and developing high-grade silver and gold assets in Mexico. Its flagship project, the Panuco Silver-Gold Project in Sinaloa, Mexico, covers a large, historically productive mining district with significant exploration potential. The company aims to expand its resources through drilling and exploration, targeting high-grade silver and gold mineralization with the goal of advancing Panuco toward production. Vizsla Silver is noted for its focus on high-quality silver assets, making it a promising player in the precious metals exploration sector.

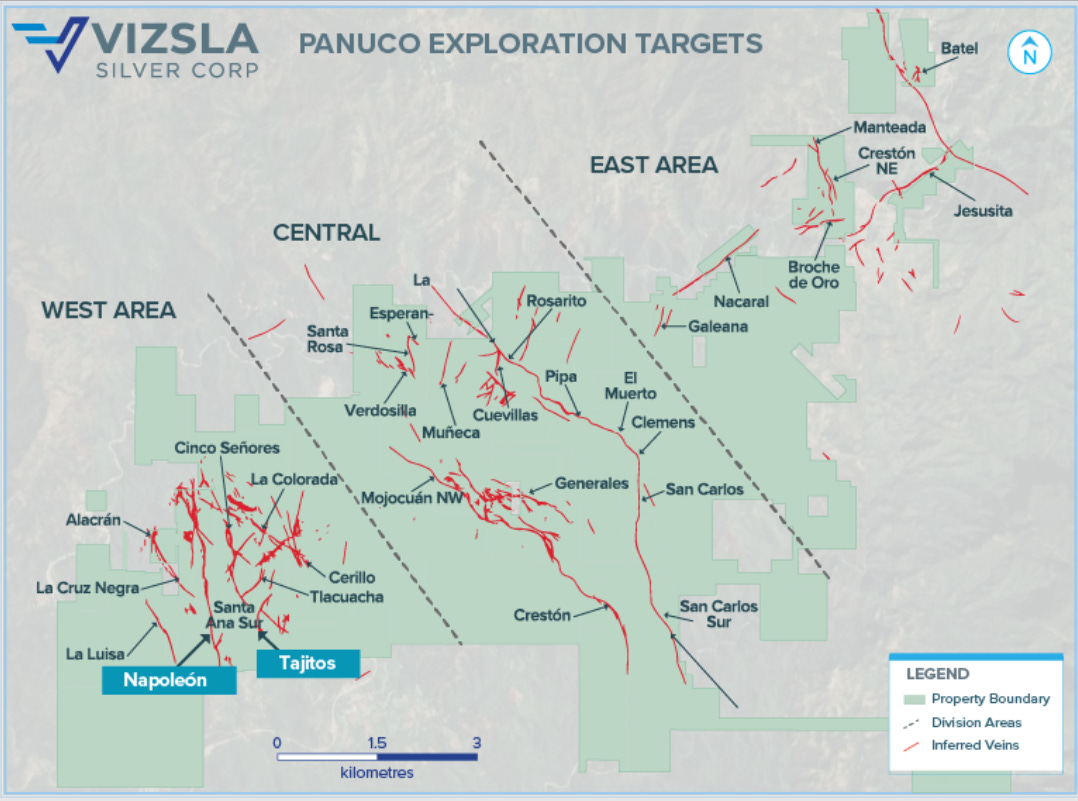

This is a picture of the Panuco Silver-Gold Project where the first image is the known veins and the second are the ones that went into the PEA:

As we can see, Vizsla Silver have only just scratched the surface regarding what is possible for Panuco Project, and what they have found so far (second image), is very promising. This is a quote from Allan Barry Laboucan over at ‘Rocks and Stocks News’:

The key recent milestone is their preliminary economic assessment (PEA) that has a base case internal rate of return (IRR) of 86% using silver and gold prices significantly lower than current prices. Using prices closer to the current spot prices pushes the IRR into the triple digits. These days, a development project in any metal is considered to be impressive if it has a 30% IRR, with most mines operating with less than that number. The IRR of Panuco is off the charts relative to other precious and base metal development projects.

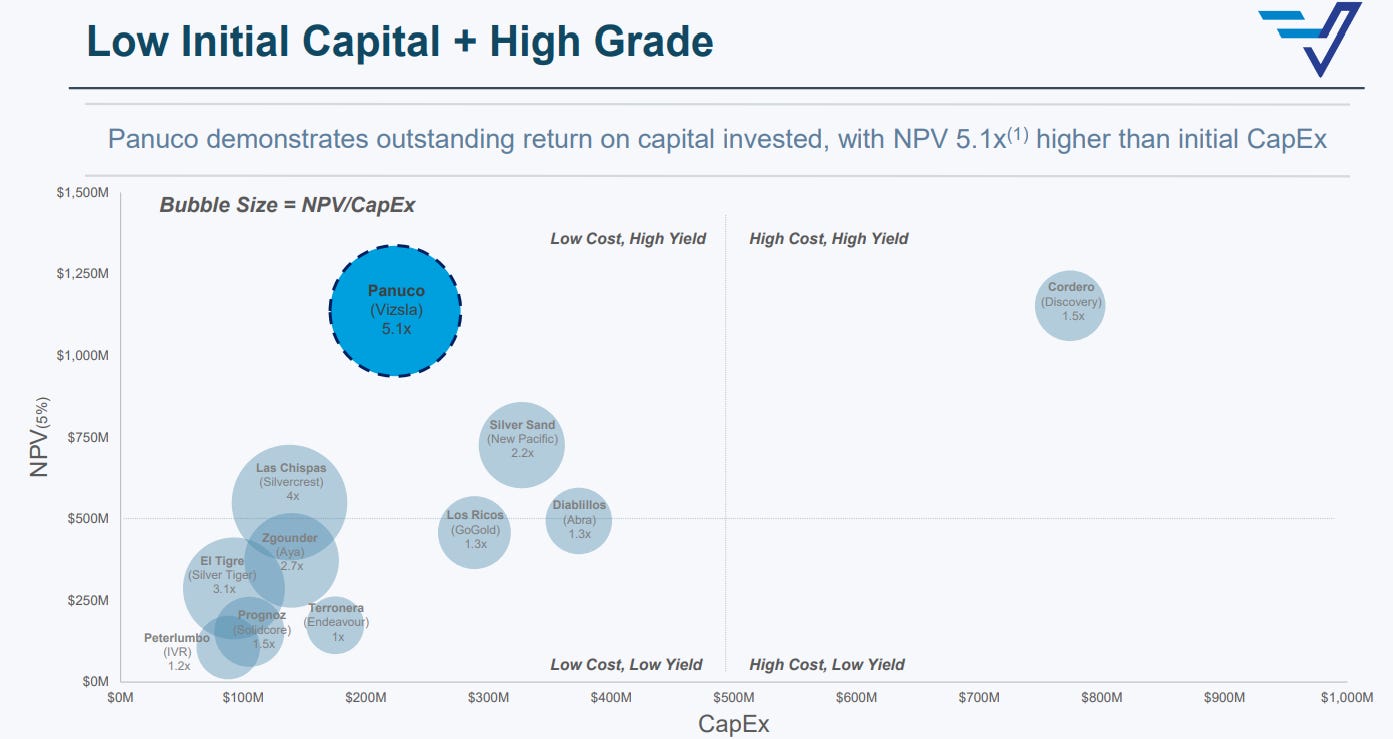

Additionally, the Panuco mine has substantially less capital cost to build the mine compared to other mines. Normally, a mine’s capital cost to build start at around $1 billion and go up from there. Panuco has an estimated capital cost of $224 million, reducing the risk of dilution (which junior miners justifiably are well known for) and increasing cash flow generation. The result is that the estimated payback for the PEA is only 9 months. For illustration and comparison, see the following picture:

Source: Company presentation

There will be a feasibility Study in H2 2025, followed by construction decision with first silver expected for H2 2027, with a test mine planned for Q4 2024 to de-risk initial production, allowing for several catalysts over the coming year and years. And this is just the beginning, looking at the pictures above, there is a lot more to be explored, making this a very enticing opportunity with several catalysts and growth prospects ahead.

Why does this opportunity exist? It’s important to understand that the silver industry historically have been consolidated down to a smaller set of larger players, reducing the number of companies who are small enough for the Panuco Project to move the needle on growth, making Vizsla Silver one of the few positioned to take advantage of this project.

So what is Vizsla Silver worth? As for most junior miners, this is an almost impossible question to answer. All we know is that Vizsla Silver has the world’s largest undeveloped high-grade silver primary resource advancing to production. To get a sense of the potential upside, Stifel recently raised their price target to $4.75, which is 2,2x above the current price of $2,17. Also, to quote Allan Barry Laboucan over at ‘Rocks and Stocks News’ again:

From a big picture perspective, when I think of Vizsla Silver it reminds me of where Barrick Gold started their path to success. They started out as a small junior that put an exceptional mine into production and used that as the foundation to grow into one of the biggest gold mining companies in the industry.

Mining companies have historically also been known for inherently bad management teams, adding more risk to this already risky sector. But, from what I’m hearing from mining experts, the Management team at Vizsla, with CEO Michael Konnert spearheading the efforts, we are looking at one of the most competent Management teams in the sector.

An important caveat is that I’m not a mining expert, and mining is inherently risky. Digging for silver in Sinaloa, Mexico (obviosuly made famous by the ruthless Sinaloa cartel) is not the least risky thing you could do in this world. I see this as a high potential lottery ticket, conservatively sized at 2,5% of my portfolio, and an excellent way to get exposure to the silver price and all it’s potential drivers, and a hedge against the general economy.

I’m long shares in Vizsla Silver as of the 11th of October with an average buy price around C$2.1.

H Capital

I assume that the NPV you used for the calculation is based on slide 17 of the "NOBV Acquisition Presentation: Juli 2024". This shows "Total Proved of CAD 609 Mln" and "Total Proved Plus Probable of CAD 931 Mln". You got to 609 Mln/27 mln shares makes appr CAD 22.50 a share. But: the footnote of that slide mentions: ".....Reserve report as at jan 1, 2024 effective date...". In the "NOBV Acquisition Video: jul 2024" Mr Marino mentions (21:06): "....a 2p total reserve at januari 1 2024 of about 68 mln barrels......over a 900 mln.....:" when referring to again slide 17. If the CAD 22.50 a share is indeed based on the NPV of 01-01-2024 then I do not understand how the asset depletion has been taken into consideration.

See my previous comment. NZT = TNZ . Apologies.